does california have an estate tax return

However there are other taxes that may apply to your wealth and property after you die. When does inheritance become taxable.

Estate Tax In Bellflower Estate Tax Income Tax Address Numbers

The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

. If you think youll need help with estate planning a financial advisor could advise you on reaching your goals. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. If the property you left behind to your heirs exceeds your lifetime gift and estate tax exemption of 117 million in 2021 or 1206 million for 2022 youd owe a federal estate tax on the portion that exceeds those thresholds.

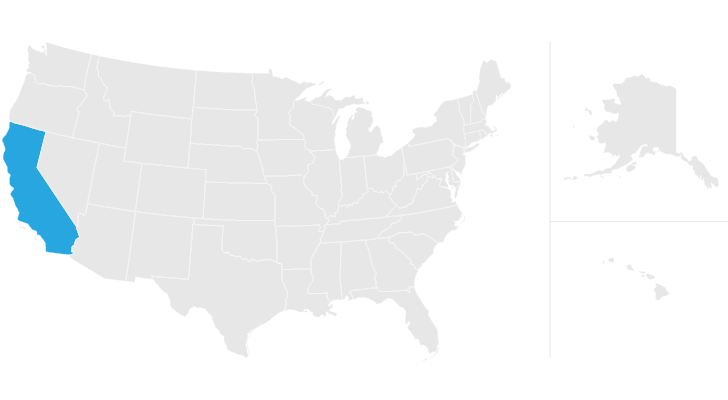

The California Revenue and Taxation Code requires every individual liable for any tax imposed by the code to file an Estate Tax Return return according to the Estate Tax Rules and Regulations prescribed by the State Controller 13501 and 14103. California is one of the 38 states that does not have an estate tax. Complete the IT-2 if a decedent had property located in California and was not a California resident.

Surprisingly California does not have its own estate tax. You have not used the exclusion in the last 2 years. This does not necessarily mean that your inheritance will be tax-free.

However the federal government enforces its own. For real estate profession Turbo tax did not allow losses and were treated passive losses and carried forward for California. Under penalty of perjury I declare that I have examined this return including accompanying attachments and statements and.

For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return. Final individual federal and state income tax returns. Estate tax also called the death tax applies to estates worth 1158 million or more.

Fortunately there is no California estate tax. Although California doesnt impose its own state taxes there are some other taxes youll need to file on behalf of the deceased. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005.

California Income Tax Return for the Estate. Before filing Form 1041 you will need to obtain a tax ID number for the estate. For more information contact the Department at 775-684-2000.

The estate tax rate can climb to as high as 40. If an estate is subject to estate tax someone will need to file Form 706 a federal estate tax return on behalf of the estate. Therefore a California Estate Tax Return is not required to be filed for decedents whose date of death is.

You inherit and deposit cash that earns interest income. However if the gift or inheritance later produces income you will need to pay tax on that income. Include only the interest earned in your gross income not the inhereted cash.

The administrator or executor of the deceased taxpayers estate by attaching certified copies of the letters of administration or letters of testamentary to the return or Entitled to the refund as the deceased taxpayers surviving. A Washington resident dies in 2019 leaving a gross estate of 4000000. IRS Form 1041 US.

This year 2019 Turbotax Home and Business version treats it differently and has given all the past and current losses as deduction for state california. California is part of the 38 states that dont impose their own estate tax. Any gain over 250000 is taxable.

That is not true in every state. You do not have to report the sale of your home if all of the following apply. A franchise tax board form 541 california fiduciary income tax return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of net income or that has an.

Form 706 estate tax return. Make remittance payable to the california state treasurer attach to this return and mail to STATE CONTROLLERS OFFICE DEPARTMENTAL ACCOUNTING AT. The Washington tax due is calculated as follows.

What California does have however is a highly onerous probate process which takes a percentage of your assets like a tax. California does not have its own estate tax nor does it have its own gift tax. The declaration enables the State Controllers Office to determine the decedents state of residence at date of death.

The decedent and their estate are separate taxable entities. A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of net income or. With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax.

Your gain from the sale was less than 250000. Some states have enacted inheritance taxes on estates of any size. A Declaration Concerning Residence form may be required when filing a California Estate Tax Return ET-1.

This is counter intuitive as California is generally a high tax state and many other states have a state level estate tax. Shows as an adjustment on form 540. If your inheritance is in Trust a portion of the income might be subject to.

However after January 1 2005 the IRS no longer allows the state death tax credit. The estate incurs funeral and attorneys fees of 50000 during the administration of the estate and the decedent had 50000 in personal debt at death. Any estate in California that has gross.

There is also no estate tax in California. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. If you received a gift or inheritance do not include it in your income.

Form 706 estate tax return. In addition to regular income tax a second kind of tax can be levied against certain estates. BOX 942850 SACRAMENTO CA 94250-0001.

You owned and occupied the home for at least 2 years. An estates tax ID number is called an employer identification. Due by tax day of the year following the individuals death.

For decedents that die on or after June 8 1982 and before January 1 2005 a California Estate Tax Return is required to be filed with the State Controllers Office if.

Income Tax Services Bellflower Tax Lawyer Tax Attorney Tax Services

Free Estate Planning Legal Documents Ez Estate Planner Living Trust Estate Planning How To Plan

Cpa Bookkeeping Estate Tax Bellflower Ca Usa Cpa Finance Bookkeeping

Filing Business Tax Returns Requires Expertise Along With A Good Set Of Financial Statements Let The Team At Whyte Business Tax Tax Return Financial Statement

Estatetaxplanning Bellflower Ca Estate Tax Income Tax Bellflower

California Estate Tax Everything You Need To Know Smartasset

Understanding California S Property Taxes

The Taxlawyerlosangeles Will Make Sure That You Are Not Accused Of The Tax Lawyer Tax Attorney Business Lawyer

California Probate A General Timeline Probate Estate Planning Financial Tips

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Estatetax Bellflower Ca How To Plan Money Control Income Tax

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Taxes Bellflower Ca Estate Tax Tax Return Bellflower

California Estate Tax Everything You Need To Know Smartasset

Estate Taxes Bellflower Ca Estate Tax Income Tax Bellflower

Does California Have An Inheritance Tax Inheritance Tax Inheritance California

Estate Tax In Bellflower Income Tax Return Estate Tax Income Tax

California Estate Tax Everything You Need To Know Smartasset